Open Enrollment is RIGHT NOW.

Medicare Enrollment

Oct 01 - Dec 07

Individual Health Insurance

Nov 01 - Dec 15

Quality

Secure

Trusted

Private-market insurance quotes from carriers such as

Insurance Services

Health Insurance

Medicare

Supplements

Obamacare

Disability Insurance

Life Insurance

Long Term Care

Group Benefits

Vision

Dental

Financial Services

Financial Education

College Planning

Retirement Planning

Estate Planning

Notary Public

SHOP MARKETPLACE PLANS AND MORE PROVIDERS NOW!

Our goal is to streamline your shopping process by quickly providing you with a range of affordable healthcare options. To do that we will provide you plan options in your area to help you find options that may fit your needs and budget!

Fast and Easy

No Commitment

Start Now

Find affordable healthcare solutions at budget-friendly options!

Get Affordable Options!

Follow a few steps for affordable plans:

Complete The Form

Fill out the form so we know what plan is best suited for you.

Get Affordable Plans

We will contact you and deliver available plan options for you to review.

Choose Your Plan

Review affordable options and select coverage that fits your needs.

Open Enrollment and Obamacare

Open Enrollment Period (OEP) is the best time to purchase individual health insurance. If you’re looking for ACA coverage for yourself, buying during OEP gives you the most options when deciding on how you want to be covered, including getting a full-coverage ACA Marketplace plan (also called an Obamacare or Exchange plan), or choosing non-Marketplace coverage.

We can help sort through your different plan options, tell you which insurance companies are offering plans, plus connect you with a licensed independent health insurance agent. We also provide helpful advice along the way.

You Are Only Clicks Away From Affordable Healthcare!

Affordable options are at your fingertips, start today!

Open Enrollment

Open Enrollment will begin November 1 to December 15. There are many plan options to choose from and many can qualify for a tax credit. Find out which plan suits you most and more importantly see how much of a tax credit you qualify for.

Penalties?

Tax Penalty is $695 per person for not having health coverage or 2.5% of household income whichever is greater.

What are my options?

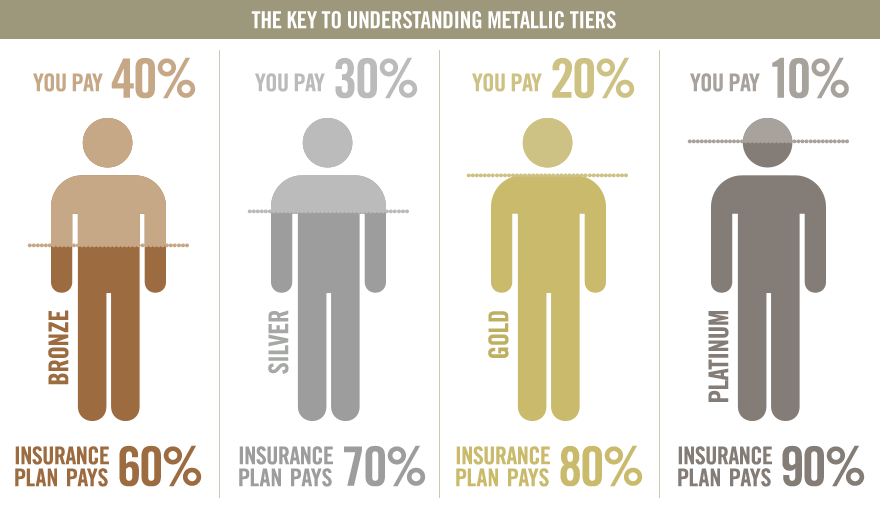

There are metallic plans to choose from. Some have high deductibles and other have no deductible. There are varies copays as well. You can choose from a Bronze, Silver, Gold or Platinum Plan. Which is best for you, depends on many factors.